Next week may bring a little bit less drama and volatility after the smorgasbord of central bank meetings we witnessed last week. Most had assumed that we would get some kind of synchronisation in the next round of policy changes and easing. But the past few days will go down in history as one in which the Bank of Japan hiked rates for the first time in 17 years, while the Swiss National Bank surprised by cutting its rate. That made it the first G10 central bank to do so in the current cycle.

Aside from making history, it was noteworthy that their two respective currencies, the yen and Swiss France, struggled with only the NZD lagging both due to New Zealand slipping into a second technical recession in 18 months. The demise of the CHF is understandable, and more cuts are expected, though it’s worth remembering the SNB meets quarterly so less frequently than other major central banks.

However, the yen hit multi-year lows versus several currencies, while USD/JPY hovers near intervention highs. An odd reaction, but Governor Ueda suggested there was little rush to add to rate hikes for now. We talked about “baby-steps” last week and this proved to be correct. In turn, we will be watching the 10-year US Treasury yield as this has a strong correlation with the major and looks to be rolling over again. Fed policy could potentially have a bigger influence on the yen in the near-term.

Amid a thinner week on the calendar, US February PCE inflation stands out. This inflation measure is widely quoted as being the Fed’s favoured inflation gauge. That is because it is broader in coverage than the more widely followed CPI data. In the central bank’s view, it better represents spending patterns of the all-important US consumer. Interestingly, FOMC officials kept their bets of 75bps of rate cuts later this year, despite hotter inflation prints in January and February. Do they know something we don’t? Chair Powell attributed this to seasonal adjustments which implies that upcoming inflation report should resume the moderation trend and make significant progress toward the 2% target. That said, Powell did say the path would be bumpy and the dollar enjoyed its best week since the start of the year.

Stock markets continued to make fresh record highs last week with momentum firmly bullish. Take your pick from a “soft landing”, “no landing” and a “Goldilocks” environment to describe the current theme. Ultimately, the Fed’s first rule is to avoid a recession at all costs, and the best way to kick one off is tipping equities into a bear market. The prospect of lower borrowing costs makes the rally more sustainable. But the rocky road for price pressures needs to decline gently for these landing scenarios to play out.

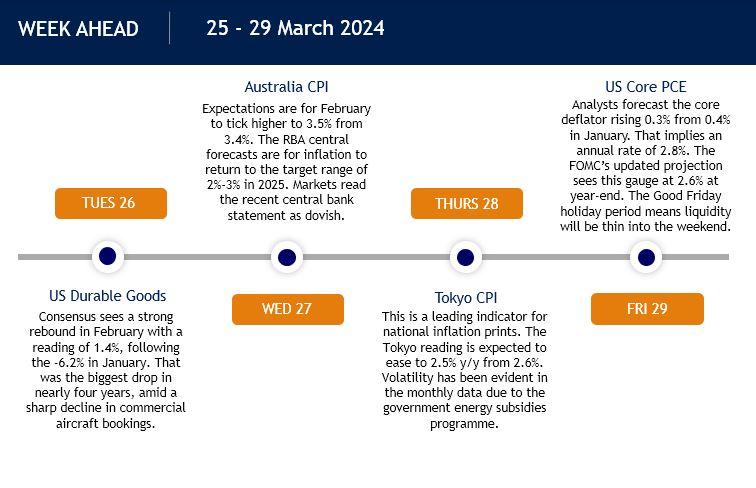

Here are the key calendar events in Easter week: