It’s a hefty week of major risk events including a very busy central bank meeting schedule. The US Federal Reserve, Bank of Japan, Bank of England, Swiss National Bank, Reserve Bank of Australia, Norges Bank and People’s Bank of China among others, all gather to discuss monetary policy with virtually all likely to leave rates unchanged. But there could be some notable policy action among them, with the BoJ and SNB potentially hiking and cutting rates respectively. The common thread pretty much for all policymakers is inflation, and more specifically, services inflation and wage growth. This will dictate price action in FX and the broader market in the case of the Fed.

Expectations of rate cuts from the Fed have been fuelling the stock market rally and also to some degree, the run-up in gold and bitcoin. We wrote last week how these bets have been yo-yoing, with mounting inflationary pressures seen last week raising more concerns about interest rate reductions. That probably means Chair Powell will reiterate that policymakers remain patient and data dependent while not wanting to pre-commit to any timings of cuts. Signals from the new economic projections and dot plot will be key. It will only take two of six FOMC members changing their mind to move the median dot away from three rate cuts down to two.

The Bank of Japan is a “live” meeting with much speculation that officials could hike rates for the first time in 17 years. With a technical recession in the second half of 2023 revised away, the latest wage negotiations point to a sharp rise in earnings. But consumption, a crucial input into the decision-making process, is still weak and Governor Ueda has stressed data dependency in reaching an appropriate policy decision. The bank also needs to try and communicate that it will take baby-steps with any policy changes to ensure the inflation dynamic remains around 2%. The yen will be volatile with a spread of opinions in the market, while a stronger currency move could be dependent on the Fed shifting to a more dovish bias.

GBP is the only major currency that is currently able to stand tall against the greenback in terms of year-to-date performance. Much of that is to do with the expectation that the Bank of England will not cut rates before August, whereas the Fed and the European Central Bank are seen easing policy in June. Inflation is likely to continue slowly moving lower with the latest print on Wednesday, following softer wage growth, while PMI data points to a mildly improving economic picture in the months ahead. The MPC is unlikely to water down its message that rates will remain high, which should underpin support for the pound.

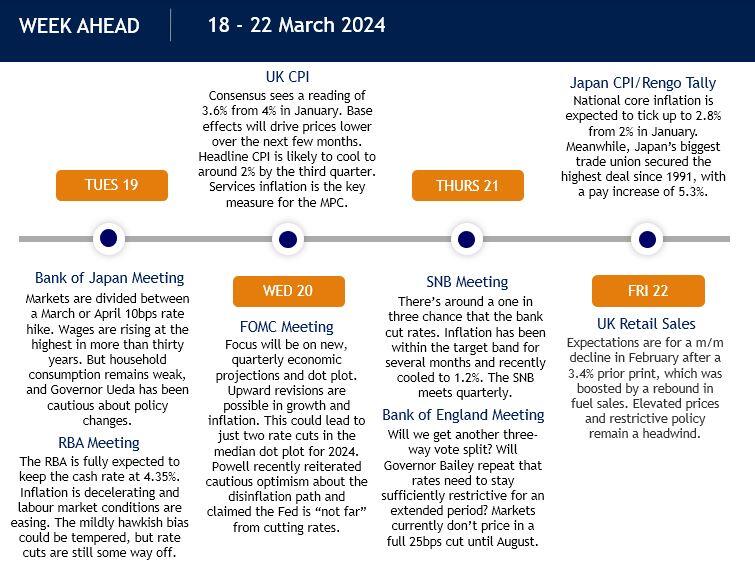

Here are the major events of the week: