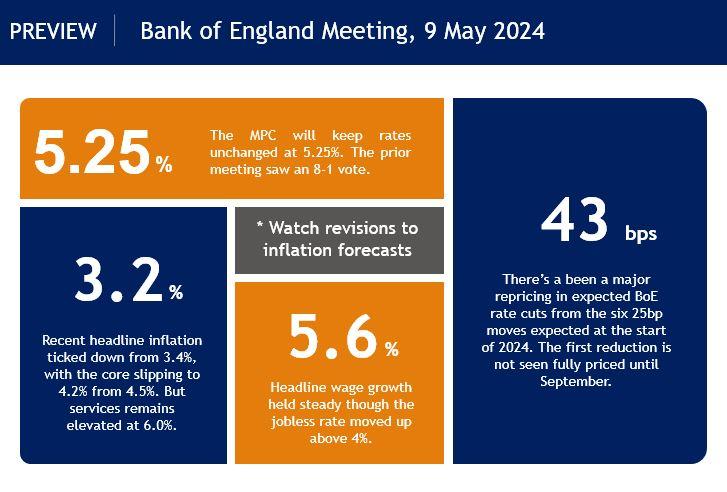

The Bank of England will keep rates unchanged at 16-year highs at 5.25% on Thursday, for the sixth consecutive meeting. The vote split is likely to remain 8-1, after the two more hawkish members, Mann and Haskel, switched to the “on hold” camp at the March meeting. There is much speculation that guidance may be tweaked in order to set up a June rate cut. But two more key inflation and wage reports are released before then, so it may be wiser for the MPC to keep all its options open to be more certain that inflation doesn’t remain persistent for longer than policymakers hope.

Data more encouraging, but price pressures still elevated

Since the last meeting, the latest CPI data has fallen further with the headline closer to 3% and the core slipping, though it still remains above 4%. However, services inflation, a key gauge for rate setters, remains sticky at 6%. Wage growth figures are also a major focus for the bank, and they remain relatively high. Other data appears to have turned a corner with GDP in positive territory. Leading indicators like PMI services figures have also been more encouraging with the composite index rising.

MPC Speak

Governor Bailey recently noted that the UK is “on track” to quell inflation. However, divisions on the MPC were laid bare after comments by previous hawk, Deputy Governor Ramsden. He said he was increasingly confident that the balance of risks on inflation are tilted to the downside, remarks which strongly implied that the market is underpricing the extent of cuts this year.

But these comments were followed up by remarks from Chief Economist Pill, who said that in his baseline scenario, “the time for cutting Bank Rate remains some way off.” Elsewhere, the likes of Mann, Haskel and Greene have been cautious on the prospects for near-term policy easing. Given the split of views at the BoE, the vote split will likely be a focus, while it could also mean not too much change to the bank’s forward guidance.

Guidance or language changes

Attention will fall on the policy statement and language, and whether the MPC opts to provide a dovish tweak or scraps its existing guidance that policy will need to remain “sufficiently restrictive” for an “extended period”. It could emphasise that it can cut rates while keeping rates restrictive, but it seems obvious the bank will need to change that language ahead of any upcoming rate cut.

Part of a dovish shift could come in the forecast profile, as the MPC is expected to revise down its inflation forecasts such that they are below target over the medium term – some saying as low as 1.5%.

Market reaction

Beyond the upcoming meeting, market pricing for the rest of the year continues to move in a hawkish direction, with the first 25bps cut not fully priced until September’s meeting, around a 35% chance of a June cut and a total of 43bps of policy easing currently priced by year-end. This is of course a substantial repricing from the six cuts that were expected at the start of the year.

GBP will get sold if dovish tweaks confirm a June cut is coming, though the bigger move could be if Bailey is more cautious and wants to keep the bank’s options open, with two more CPI and wage data reports before the June meeting.

Here are the main numbers to know: