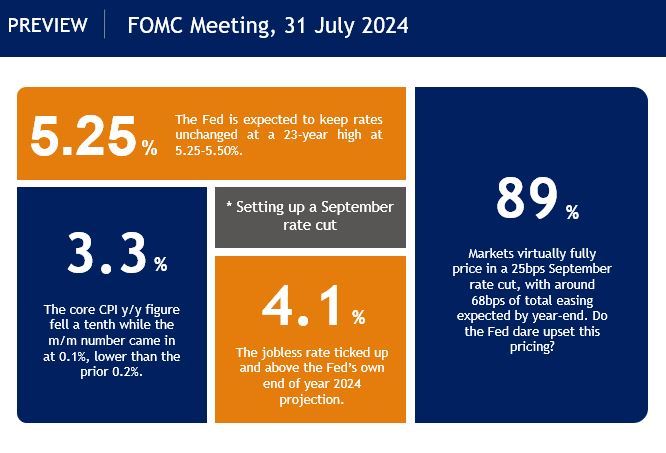

Wednesday sees the FOMC meet with markets expecting rates to be kept on hold at 5.25 – 5.50%. This decision is in between the June and Sept forecast rounds so there are no dot plot updates of rate expectations and a summary of economic projections as these are published quarterly. Discussion around Fed policy has ebbed and flowed this year between mass rate cuts to virtually nothing priced for 2024.

In recent months, we have seen the first quarter inflation surprises neutralised by more benign outcomes through the most recent three months. At the same time, expectations for the labour market (Non-Farm Payrolls released after the Fed meet) continue to soften as a better balance between supply and demand is gradually coming into view.

That has meant the Fed is now widely expected to lay the groundwork for a September rate cut at this meeting as policymakers express growing confidence inflation is on the path to 2% and that economic challenges are an increasing focus. The data is also expected to point towards policy easing with employment costs easing, business surveys cooling and the key jobs report indicating growing slack in the labour market.

Flexibility and more confidence still needed?

That said, the FOMC may want to express flexibility to assess two rounds of CPI and one more PCE report, plus two more job reports between now and the September meeting. Of course, there is currently a soft patch in core inflation with a few months of soft readings, but rate setters might want to have truly “greater” confidence of making progress towards its 2% inflation goal so require more data.

Otherwise, possible tweaks to the statement could come in the opening paragraph and whether “there has been modest further progress” toward achieving the 2% inflation target or something that signals more confidence. It might also be worth watching if the reference to the FOMC holding off on rate cuts “until it has gained greater confidence” that inflation is moving toward 2% is strengthened to signal that this is being achieved.

Market reaction

Money markets have fully discounted a September 25bps rate reduction to 5.00-5.25%. Additionally, markets fully price the Fed cutting rates again by the end of this year and are assigning above a 50% chance of a third rate cut. That is in contrast with the Fed’s June economic projections, where policymakers pencilled in just one cut this year.

Assuming things pan out as markets expect, the Fed will likely use the Jackson Hole symposium at the end of August to show they’re re-evaluating the outlook and will be cutting their growth and inflation forecasts and raising their unemployment projection in September. The dollar could come under pressure, even if the Fed are more cautious about policy easing, as markets eye up Jackson Hole.

Here are some key numbers to know ahead of the meeting: