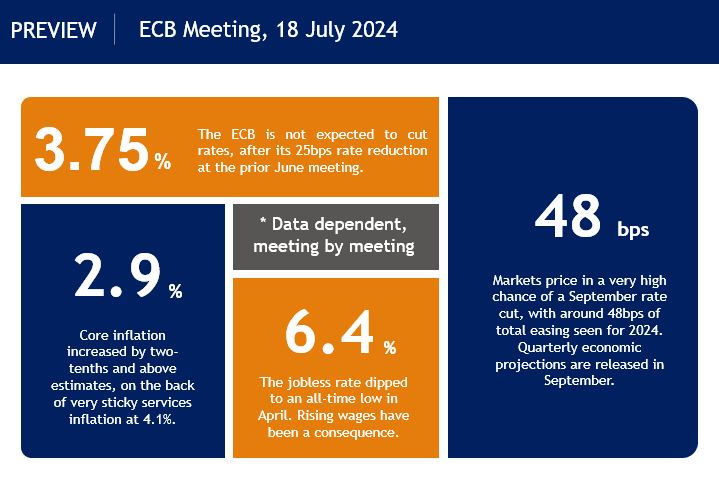

The ECB is widely expected to keep interest rates on hold at its meeting tomorrow. The prior gathering saw policymakers cut rates for the first time since September 2019 with the accompanying statement noting that the “Governing Council is not pre-committing to a particular rate path.” That means this is likely to be a stock taking meeting with the ECB watching data and keeping their options open through the summer, unlike the very strongly telegraphed June rate reduction.

Data since that meeting has seen headline inflation tick lower to 2.5% from 2.6%, but sticky services inflation above 4%, with annual wage growth of about 5% keeping core inflation at 2.9% in June. PMI metrics saw the region’s manufacturing and services prints decline, leaving the composite at a precarious 50.9 versus the prior 52.2. In the labour market, the unemployment rate remains at its record low of 6.4%, which the ECB hawks say means there is no need to rush further rate cuts.

ECB rhetoric

Most ECBspeak has suggested a move lower in rates this month is very unlikely with President Lagarde stating officials are in no hurry to cut rates again after the June move and the central bank requires additional reassurance that inflation is headed back towards 2% before more policy easing. Hawks certainly need more convincing that wage and services inflation is turning.

The doves say the latest data shows the recent uptick in eurozone growth is already losing steam. Indeed, President Lagarde recently said rate setters needs to be mindful of the fact that the growth outlook remains uncertain.

As such, it looks like the upcoming meeting will largely be quiet with policymakers set to sit on their hands, preaching data dependency between now and September. That meeting sees new quarterly staff economic projections for growth and inflation.

Market reaction

Money market pricing currently assigns around an 85% chance of a September rate cut with a total of 48bps of easing seen by year-end. A pushback on a “normal” rate cutting cycle, a “hawkish hold”, could boost the euro and push it towards the March highs at 1.0981 and beyond. But explicitly lining up another rate reduction in September could hit the single currency with initial support at the midpoint of this year’s high to low move at .1.0870.

Here are the key numbers to know ahead of the meeting: