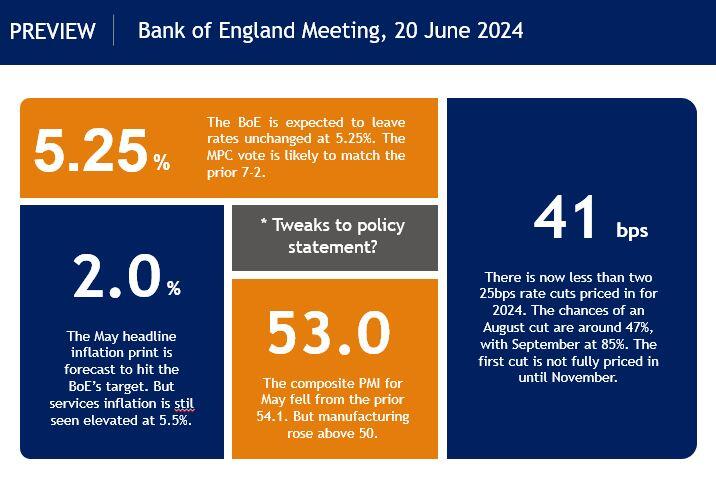

The Bank of England is widely expected to keep rates steady at a 16-year high of 5.25% when the MPC meets on Thursday. The vote is predicted to be 7-2 with the majority voting for an unchanged decision and Ramsden and Dhingra wanting a rate cut. The big question is whether the bank sticks to previous guidance and primes the market for an August kick-off to a cutting cycle. Keeping policy restrictive for “an extended period” is the key phrase to watch.

Of course, before we get to that point, there is the general election on July 4 which may preclude any significant changes to forward guidance at this meeting. We also do not get any fresh projections or MPC press conference on Thursday.

Data still decent, eyes on CPI

The most recent economic data has been slightly stronger than expected with first quarter GDP printing at 0.6%, which compares with the bank’s forecast of 0.4%. Forward-looking PMI figures have been mixed with the services reading slipping to 52.9 from 55.0 but manufacturing rising into expansionary territory at 51.2 from 49.1. Services inflation is the key metric for the MPC and that remains hot, while wage growth is elevated and underpinned by the recent National Living Wage rise.

Markets will be on watch for Wednesday’s May CPI data which could affect the meeting’s bias in terms of guidance. Expectations are for the headline to hit the bank’s 2% target, which would be just above their forecast of 1.9%. This will be driven down by good prices as lower energy prices filter through the supply chain. The core is predicted to print at 3.3% and services inflation at 5.5%, down from the prior 5.9% but still sticky.

Policy perspective and market reaction

The BoE has cancelled all public communications during the election campaign as it wishes to stay out of the political fray. This could add reasons to be guarded on changes to forward guidance. We did hear from Chief Economist Pill in the aftermath of the May meeting, who said it wasn’t unreasonable to see a summer rate cut, which would still keep policy restrictive.

Current pricing for a first August rate cut is around a coin toss with roughly 41 bps of rate cuts priced in for 2024. Ultimately, this will come down to whether persistent domestic price pressures are still seen in the inflation data. A sharp drop in services CPI could see markets expecting a dovish tilt to the BoE’s statement. That would likely hurt sterling. The flip side sees a quiet meeting as officials mark time and want to see more progress on the disinflation front.

Here are the key numbers to know ahead of the meeting: