The term “order” refers to how a trader will enter and exit their trade. There are a number of different order types that can be applied to a trade on MT4.

Market order

A market order is simply an order that is executed at the current market price, the moment you decide to buy or sell. You will be given the best available price at the time of execution.

In the example below, you can see a market order for EURUSD with a current “bid price” of 1.15534 and an “ask price” of 1.15543 on the MT4 platform.

If you wanted to buy EURUSD at the market price, then it would be sold to you at the ask price of 1.15543. If you click ‘Buy by Market’ your buy order trade would be instantly executed at that price.

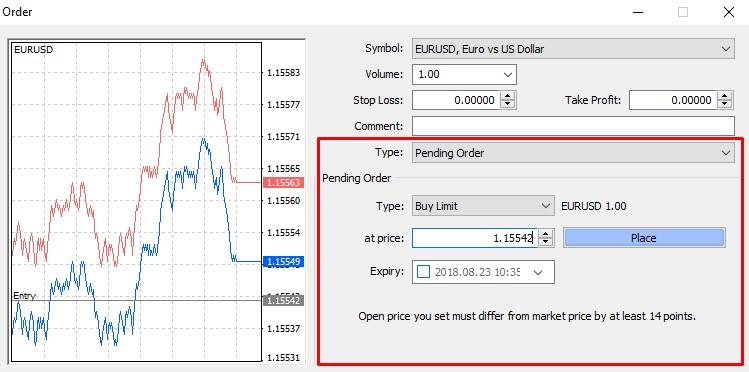

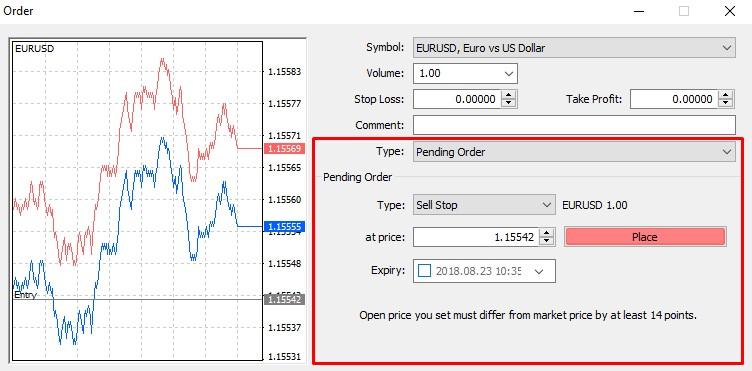

Stop Entry Orders

As well as using stops to close a position, you can also open new trades with them. These are called ‘stop entry orders’.

A stop entry order is an instruction to either buy above the current market price or sell below the current market price at a certain predefined price set by the trader.

For example, let’s say USDJPY is currently trading at 110.20. You believe the price will continue to rise if it hits 110.30. If this is the case you would set a buy stop order at 110.30. Once set, this means that if the price of USDJPY hits 110.30 and continues to rise, MT4 will automatically execute your buy stop order at the best available price.

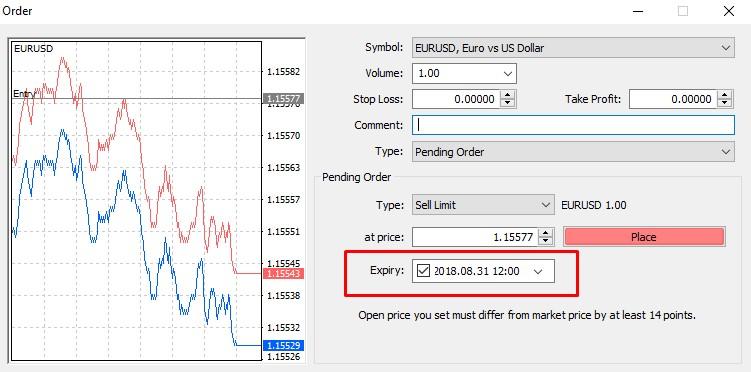

Good Till Cancelled & Good Till Date

There are also two different time settings you can apply to your pending orders – good till cancelled (GTC) and good till date (GTD).

Good till cancelled (GTC), means the pending order will remain on the system until it is either filled or cancelled. The order will remain active until that point. Good till date (GTD) is an order that remains active until a specified expiry date and time.

You can modify or cancel your pending order at any time, as long as the order has not been filled.

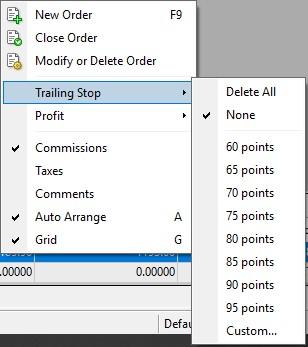

Trailing Stops

A trailing stop is a dynamic stop loss order that moves your stop loss level automatically as the market price of that instrument fluctuates.

For example, you open a sell position (short) for USDJPY at an entry price of 109.70. You then decide to set a trailing stop of 20 pips.

This means originally your stop loss would be placed at 109.90. However, if the market price goes down to say 109.50, then your trailing stop would move down to 109.70 (which would be breakeven as this was your entry price). If the price of USDJPY continues to move down to say 109.35, then your trailing stop would move to 109.55, essentially locking you in a 15 pip profit.

Remember, in this example your position would remain open until the market price moved against you by 20 pips. Once the trailing stop would be hit, an order would be executed to close out the existing position. To add a trailing stop on MT4, right click on your open position in the Terminal window and click ‘Trailing Stop’. You can then choose how many points you wish to set the trailing stop for. On MT4, the minimum trailing stop level you can set is 15 points. However, you are able to set a custom trailing stop level if you wish.

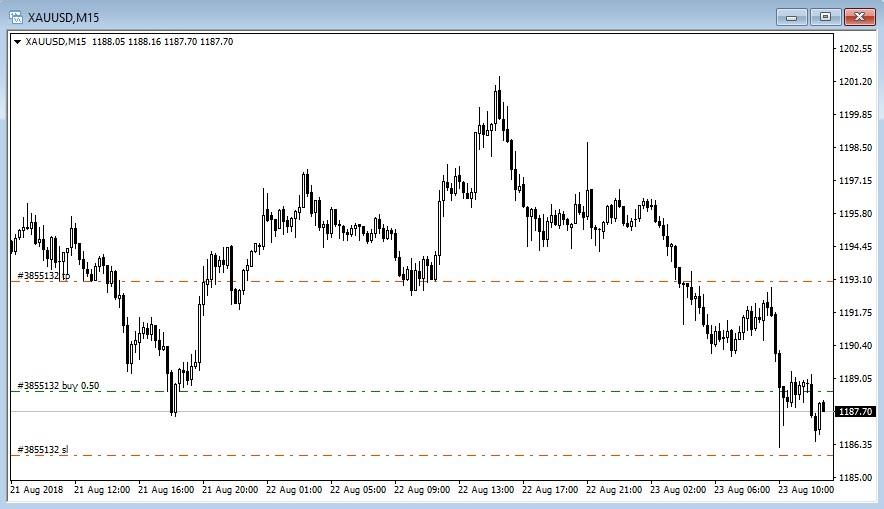

Example of a trade with entry, stop loss and take profit levels

Slippage

Remember, placing a normal stop loss does not 100% guarantee you will be filled at that particular market price. This is due to what is known as ‘slippage’. Slippage is the difference between the requested market price and the actual price that the trade was filled at. Slippage is based on two factors, liquidity and volatility. It can occur in fast-changing market conditions or in markets where there is a lack of liquidity.