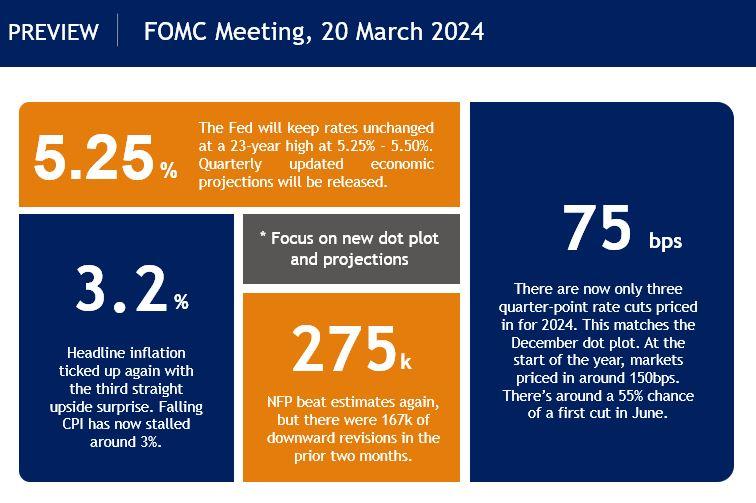

This week is full of heavyweight central bank meetings, but it will be dominated by the Fed who will leave rates unchanged at a 23-year high. A new set of economic projections and dot plot will take centre stage and guide markets around the current views of policymakers on the easing of policy and the enduring resilience of the US economy.

Chair Powell said only last week that the Fed is “not far” from having the confidence to dial back on the restrictiveness of policy. But sticky inflation and a solid labour market set the stage for a fascinating meeting, with the exact timing and extent of cuts uncertain. A reversion to contained inflation is essential for the Fed to consider cutting rates by June.

Major risk is hawkish twist to dot plot

However, due to inflationary pressures persisting, those looking for precise signals on the size and timing of policy easing may be left disappointed. There is a major risk of a less dovish twist to the 75bps of rate cuts seen in December’s median dot plot for this year. That is because it will only take two of six FOMC members changing their minds to move the updated median dot down to 50bp of policy rate cuts this year.

This hawkish shift is not a consensus call so would spark volatility and boost the dollar, which posted its first positive week in four, and likely hurt risk markets. Powell will need to tread a fine line between convincing markets rate cuts will come, while at the same time cautioning that the Fed can be patient.

Market reaction

Market expectations have been yo-yoing this year between 150bps of rate cuts and half of this across 2024. The huge shift from mid-January, when markets saw an almost 80% chance of a rate reduction at this week’s meeting, is telling. There is now only a 55% chance of a first 25bp rate cut in June.

Ultimately, the FOMC’s future decisions will depend hugely on the data, with the dot plot only acting as a guide. Most officials have said they are keeping a close on incoming information, while suggesting policy easing is likely, without specifying timing or magnitude. The inflation picture is mixed currently, and one moved by just a few components which aren’t meant to lead to sustained upside price pressures. Patience and a data dependent Fed in no rush to cut rates seems the most probable route for this meeting.

Here are some key numbers to know ahead of the meeting: