It’s a new quarter and month which means the Friday US employment report will take centre stage. Despite the monthly moderation in last Friday’s US PCE inflation, the upward revisions to prior rates for both the headline and core measures remain a black mark on the Fed’s goal of returning to the 2% inflation target. It is likely to take more evidence of moderation in the months ahead to give the Fed the confidence to pull the trigger on its first rate cut this year. Meantime, there was a mixed picture with strong consumer spending last month bolstering forecasts of first quarter GDP, while the drop in the personal saving rate points to a spending slowdown in the second quarter.

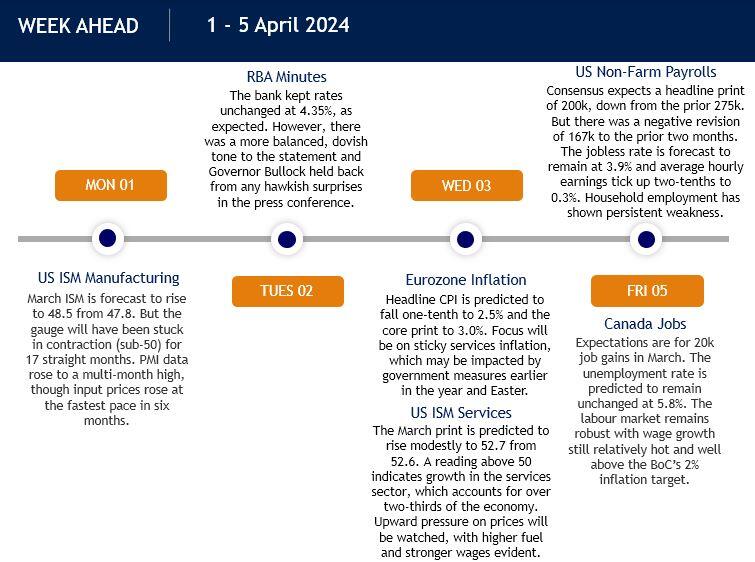

As well as the marquee US jobs report, we get a host of Fed speakers and important soft survey data in the form of the ISM figures. These gauges of activity can often inform expectations for hard data so will be of interest to markets who currently assign around a 64% chance of a first Fed 25bps cut in June.

Of course, the NFP data will grab the headlines with payrolls expected to rise solidly, with job gains mainly concentrated in just three sectors. The jobless rate should remain below 4% with wage growth still relatively benign. A broadly set of positive data should confirm the current environment, while a hotter set of figures would dent rate cut bets and further boost USD. That would also further cement recent comments by various FOMC officials, including Chair Powell and Waller, that they are in no rush to cut rates.

Stalling US inflation has not been replicated in Europe, with consistent downward pressure seen in both the headline and core measures in recent months. ECB officials have all been recently singing from the same June rate cut sheet too, so only outsized CPI readings on Wednesday would upset markets. That said, there may be some noise in this release, which means policymakers may look though this ahead of next week’s ECB meeting. President Lagarde recently stated we’ll all know a lot more in June. EUR/USD lost 1.08 support last week so could eye up the 1.07 region below if the disinflation story continues apace.

Here are the main calendar events: